En el ámbito del deporte, la competición verano se ha convertido en un campo crucial para el desarrollo de atletas y conjuntos. Con eventos que atraen la atención mundial, resulta fundamental observar y comprender cómo se han presentado los participantes en estas ocasiones. Este análisis no solo se centra en las estadísticas y resultados históricos, sino que también implica una reflexión profunda sobre las lecciones aprendidas y las áreas de mejora.

La revisión de los logros pasados ofrece una visión clara de la trayectoria de cada participante, y puede servir como base para el crecimiento y el desarrollo talentos. Aprovechar la información acumulada a través de los años permite identificar patrones y tendencias que pueden ser aplicadas en futuras confrontaciones. Asimismo, una adecuada valoración del desempeño en estos torneos puede influir positivamente en la formación de jóvenes deportistas, asegurando así un futuro prometedor para el deporte.

Métricas clave para evaluar el desempeño de jugadores en torneos internacionales

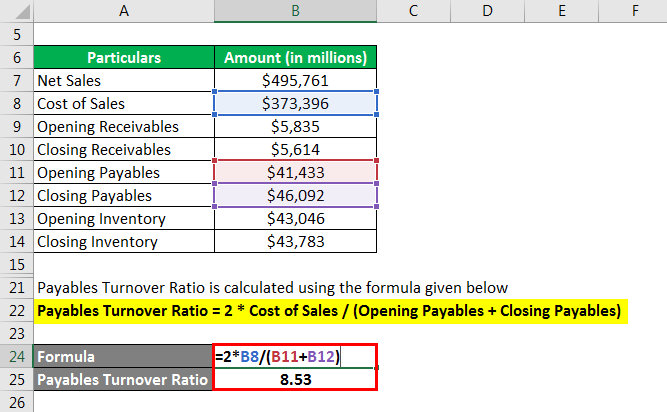

El análisis del desempeño de los futbolistas en certámenes globales es fundamental para entender su evolución y su impacto en los resultados del conjunto. Para lograr una evaluación precisa, es necesario considerar métricas que reflejen no solo los resultados históricos, sino también la contribución individual de cada jugador.

Entre las métricas más importantes se encuentra el número de goles y asistencias, que indican la capacidad ofensiva de los talentos en el campo. Sin embargo, también es crucial observar las estadísticas defensivas, como robos de balón y despejes, lo que permite obtener una visión integral del atleta.

El análisis internacional a menudo se apoya en el uso de la tecnología y herramientas avanzadas, como el seguimiento de la posición y el movimiento de los futbolistas durante los partidos. Esto facilita la identificación de patrones de comportamiento y la toma de decisiones tácticas más efectivas.

Además de las cifras, el aspecto psicológico juega un rol esencial en el desarrollo talentos. La resiliencia y la capacidad de los jugadores para manejar la presión en situaciones críticas son elementos que requieren atención especial para una valoración completa de su potencial.

Por último, es recomendable integrar un enfoque multidimensional que contemple tanto las estadísticas cuantitativas como cualitativas. Esto no solo enriquecerá el proceso de selección y entrenamiento, sino que también permitirá fomentar el crecimiento de los jóvenes atletas en el ámbito competitivo.

Herramientas tecnológicas para el análisis del juego en competencias de verano

En el mundo del deporte, la implementación de herramientas tecnológicas se ha convertido en un elemento esencial para el desarrollo talentos y la mejora continua de los jugadores. Durante el período de competición verano, éstas se utilizan para obtener información valiosa que permite identificar áreas de mejora y optimizar estrategias.

Una de las tecnologías más destacadas es el uso de software de análisis de video, que permite revisar jugadas clave y momentos críticos. Esta herramienta ayuda a los entrenadores y atletas a evaluar decisiones en tiempo real, facilitando un enfoque más detallado en la táctica y la técnica.

Además, los dispositivos de seguimiento GPS son fundamentales para recopilar datos sobre el rendimiento físico de los deportistas. Este tipo de información permite entender más a fondo los patrones de movimiento y la resistencia, aspectos cruciales en la competición verano.

Otra herramienta innovadora es el uso de plataformas de big data, que integran diversas métricas en un solo lugar, brindando una visión global del desempeño. Estas aplicaciones permiten comparar distintos jugadores y equipos, ayudando a los entrenadores a tomar decisiones informadas sobre tácticas y alineaciones.

En resumen, las tecnologías contemporáneas están revolucionando la forma en que se evalúan y desarrollan los talentos en el ámbito deportivo. Con herramientas adecuadas, es posible elevar el nivel de juego y maximizar el potencial de cada deportista durante la análisis internacional.

Interpretación de resultados: estrategias para mejorar el rendimiento en futuras competiciones

La interpretación de resultados es fundamental para el crecimiento y la superación de un grupo en eventos deportivos. Al analizar los resultados históricos, se pueden identificar patrones y tendencias que informan sobre el desempeño en torneos previos. Este enfoque ayuda a los entrenadores y a los jugadores a comprender mejor las áreas que requieren atención y mejoramiento.

Una de las estrategias clave es la implementación de programas de desarrollo talentos. Centrarse en la formación de habilidades específicas y en el fortalecimiento de debilidades observadas durante competiciones anteriores puede marcar una diferencia significativa. Este tipo de desarrollo debe incluir ejercicios estratégicos que simulen situaciones de juego reales, brindando a los atletas la oportunidad de practicar y perfeccionar sus técnicas.

Además, el uso de herramientas tecnológicas para el análisis internacional puede ofrecer nuevos ángulos desde los cuales observar el rendimiento. Plataformas que ofrecen estadísticas detalladas ayudan a trazar un cuadro claro de lo que funciona y lo que no. Mediante el acceso a datos precisos, es posible ajustar tácticas y formación de un modo más efectivo.

Finalmente, para aquellos que buscan profundizar en el análisis de desempeño y estrategias de mejora, se recomienda visitar https://pronosticosdeportivos24.com, un recurso valioso que puede ofrecer información adicional y diferentes perspectivas sobre cómo utilizar los resultados para mejorar las actuaciones futuras.